IRS 8404 2025-2026 free printable template

Get, Create, Make and Sign IRS 8404

Editing IRS 8404 online

Uncompromising security for your PDF editing and eSignature needs

IRS 8404 Form Versions

How to fill out IRS 8404

How to fill out 2025 form 8404

Who needs 2025 form 8404?

2025 Form 8404: A Comprehensive Guide for Filers

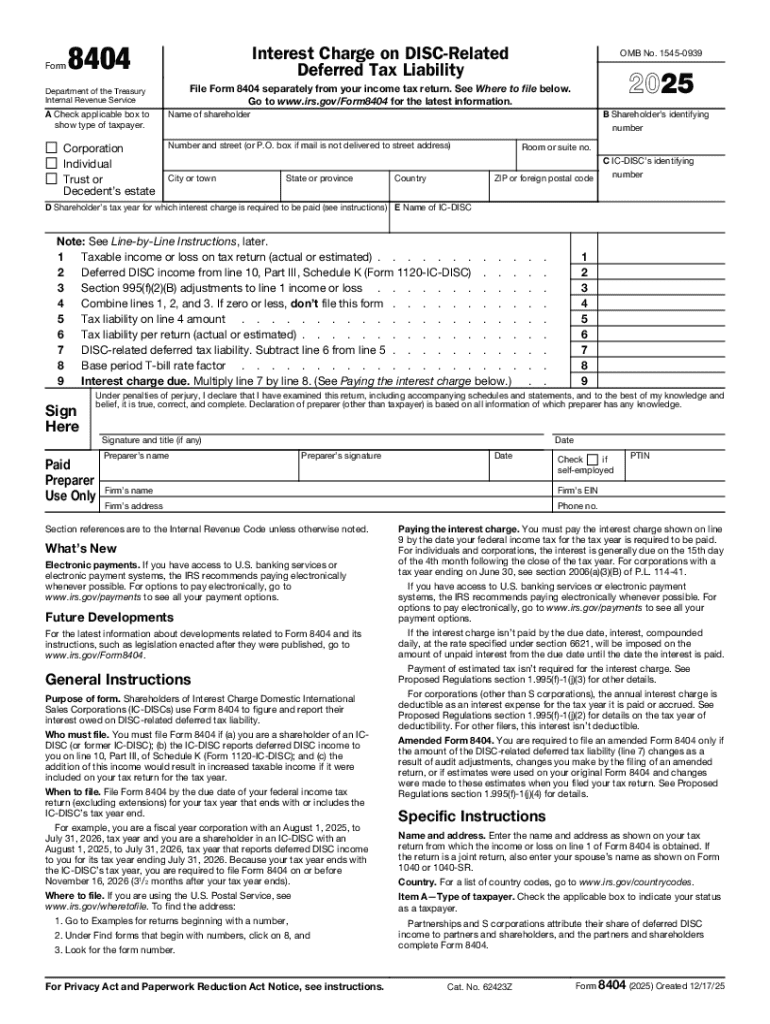

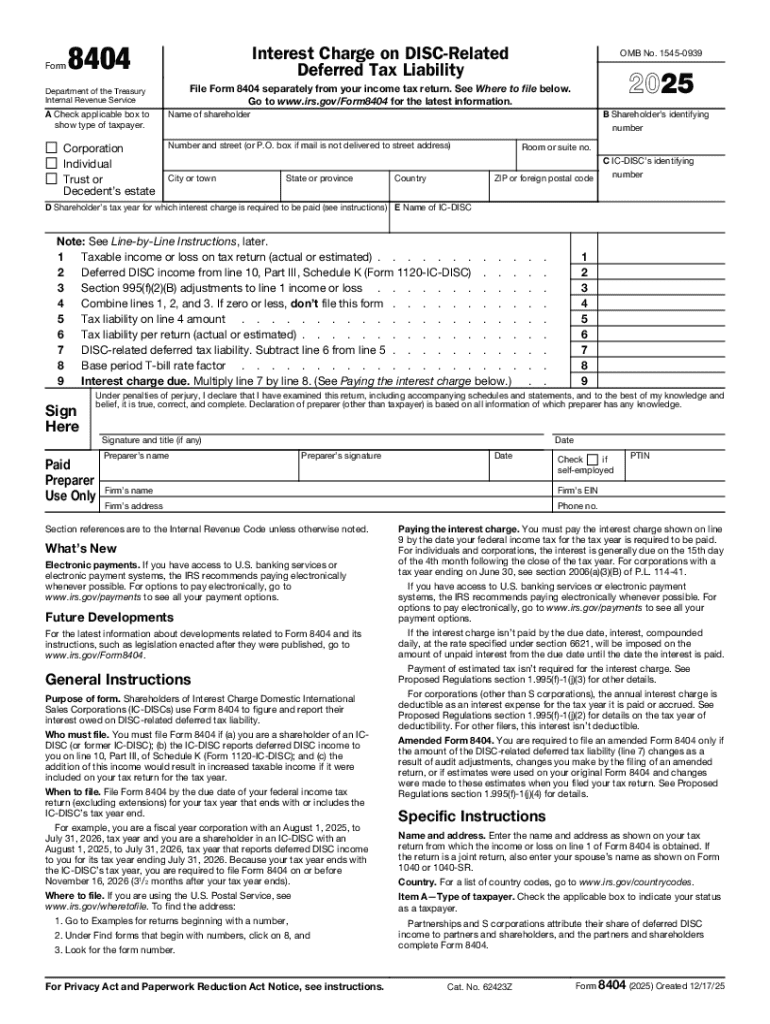

Overview of Form 8404

Form 8404 is a crucial document issued by the IRS, designed specifically for exporters and those interested in tax benefits related to export activities. This form ensures that eligible taxpayers can leverage tax savings through the Interest Charge Domestic International Sales Corporation (IC-DISC) provisions. The 2025 version of Form 8404 introduces key updates and clarifications, particularly in reporting requirements and definitions, making it essential for stakeholders to familiarize themselves to optimize their tax strategies.

Notably, differences in the 2025 Form 8404 compared to earlier versions include enhanced clarity about who qualifies for specific deductions and changes in the procedures for documenting export activities. These revisions reflect an ongoing effort by the IRS to refine the process and minimize errors among taxpayers.

Who needs to file Form 8404?

Eligibility to file Form 8404 primarily depends on whether an individual or business engages in export activities that may qualify for income tax benefits under the IC-DISC structure. Typically, businesses involved in the manufacturing or sale of goods and services for export are prime candidates. Additionally, eligible organizations include corporations and partnerships, whereas non-profits may have special considerations regarding filing requirements.

Common questions arise about who exactly must file. A general rule is that if a taxpayer's export activities exceed a certain revenue threshold, filing Form 8404 becomes necessary. Moreover, shareholders of companies that operate under the IC-DISC provisions need to be particularly vigilant about compliance.

Purpose of Form 8404

The primary purpose of Form 8404 is to facilitate tax computations related to export activities and the corresponding IC-DISC elections. By filing this form, taxpayers can position themselves to benefit from significant tax reductions on qualifying income derived from exports. This not only aids in effective tax planning but also ultimately supports the growth of U.S. international trade.

For exporters looking to optimize their tax liability, understanding Form 8404's objectives is paramount. Beyond purely tax calculations, the form serves as a formal declaration to the IRS that emphasizes a taxpayer's engagement in export activities that warrant consideration for special tax rates or deductions. In this way, it acts as a vital component of a comprehensive tax strategy.

Filing instructions for Form 8404

Filing Form 8404 can be accomplished through two primary methods: online submission and traditional paper filing. Online submission often proves more efficient, allowing for quicker processing and immediate confirmation of receipt. For those opting for paper filing, it is essential to ensure timely mailing to avoid late penalties.

Regardless of the chosen method, it is vital to adhere to the specific timeline dictated by IRS regulations for 2025. Missing deadlines can lead to penalties that might include interest charges and additional tax liabilities. To streamline the filing process, taxpayers should prepare their documentation in advance, verifying that all sections of the form are accurately completed. Common mistakes, such as incorrect figures or failed signatures, can delay approval and trigger unnecessary scrutiny.

Step-by-step guide: How to complete Form 8404

Completing Form 8404 effectively requires a clear understanding of its sections. The form is divided into three main sections: Section A focuses on general information, Section B addresses export activities in detail, and Section C is dedicated to tax computation. Filling out these parts accurately is essential for successful filing.

In Section A, filers must provide basic identification information including taxpayer identification numbers and business names. Section B requires detailed reporting of export activities, such as product descriptions and sales quantities. Finally, Section C involves calculations that determine the appropriate tax credits. Utilizing tools like pdfFiller can significantly simplify this process, as it allows users to fill, edit, and sign documents seamlessly while guiding them through each step with visual aids.

Deadlines and penalties

For the tax year 2025, the IRS has set specific deadlines for filing Form 8404, which typically falls on April 15 of the following year, unless an extension is granted. This deadline is critical, as failure to file on time can lead to severe penalties, including fines and accrued interest on unpaid taxes.

To mitigate risks, filers should stay organized and begin the process well ahead of the deadline. Employing correct record-keeping strategies ensures that businesses can avoid mistakes and therefore penalties. Regularly consulting with tax professionals familiar with Form 8404 will also help eliminate uncertainties and further reduce the risk of late filing.

Common IRS audit triggers for Form 8404

Certain factors can increase the likelihood of an IRS audit related to Form 8404 filings. High-risk areas may include discrepancies between reported export activities and supporting documentation, or unusually high deductions that stand out as inconsistent when compared to similar businesses. Such anomalies may raise red flags, prompting the IRS to scrutinize a taxpayer's return.

Preparing for a potential audit begins with thorough documentation. Maintaining accurate records and having all relevant paperwork accessible can significantly bolster a taxpayer’s case. Furthermore, ensuring compliance with regulations and demonstrating good faith in all filings can alleviate concerns and reduce anxiety surrounding audits.

State-specific considerations for Form 8404

State regulations greatly influence the filing of Form 8404, as certain jurisdictions may impose additional requirements or differ in their tax codes. Thus, exporters must be mindful of their state-specific obligations when filing. States such as California and Texas, which have their own export-related incentives, might necessitate additional forms, targeting specific that align with state-level tax benefits.

Understanding these variations is vital for compliance and maximizing potential tax savings. A proactive approach involves consulting local regulations and possibly seeking advice from tax professionals who specialize in both federal and state tax law.

Alternatives to -DISC tax deferrals

While IC-DISC remains a favorable structure for many exporters, alternatives do exist that can provide similar deferral benefits. Other tax deferral options may include foreign sales corporations (FSC) and other strategic tax planning vehicles. Evaluating these alternatives generally depends on specific business activities, the nature of exported goods, and overall tax strategy.

Businesses should carefully consider their situations and consult tax professionals before deciding to move away from the IC-DISC option. A comprehensive understanding of these alternatives' implications can lead to greater tax efficiency and potentially more beneficial outcomes for exporters.

Interactive tools for filing Form 8404

Utilizing digital tools such as those offered by pdfFiller can streamline the complexities associated with Form 8404. With advanced features for filling, editing, signing, and collaborating on forms, pdfFiller simplifies the submission process while keeping users organized. Such tools can also provide necessary prompts and reminders for deadlines, ensuring timely and accurate submissions.

User feedback has consistently highlighted the effectiveness of pdfFiller in managing and completing documentation, enhancing the overall filing experience. By leveraging these solutions, individuals and teams can drastically cut down on the time and effort spent on paperwork, focusing instead on growing their business.

Best practices for maintaining compliance

To ensure compliance with 2025 Form 8404 regulations, maintaining solid record-keeping practices is essential. This includes keeping meticulous records of exports, corresponding income, and relevant tax documentation. Regularly scheduled reviews of tax submissions and financial statements will help identify and rectify any anomalies before they trigger an audit.

Additionally, employing templates for documentation and deadline tracking can significantly enhance efficiency. Staying informed about evolving regulations is vital for maintaining compliance, as changes often occur at both federal and state levels, which can impact tax liabilities for exporters.

FAQs regarding Form 8404

Many individuals have typical questions surrounding Form 8404, ranging from basic filing requirements to complex tax implications. Filers often seek clarifications on specific instructions, such as what to include in the export activities section or how to handle adjustments if inaccuracies arise.

Providing clear answers to these frequently asked questions not only demystifies the filing process for many but also empowers filers to take charge of their tax duties confidently. As the tax landscape evolves, staying informed and seeking out reputable sources of information remains crucial for all taxpayers.

People Also Ask about

What is the formula for calculating income tax?

How do you calculate tax on salary?

How do u calculate tax?

How much is the tax for 50000 pesos salary in Philippines?

How to calculate income tax on salary with example Philippines?

How to calculate tax?

What is the basic tax formula?

How income tax is calculated with example?

How Canada tax is calculated?

How do I calculate my overall tax rate?

What are the federal and provincial tax rates for 2022?

How do you calculate tax in Canada?

What will the tax rate be in 2022?

What is the tax rate in Canada 2022?

How do I calculate income for tax?

What is the formula to calculate the tax?

How much tax will I pay on my income in Canada?

How is tax calculated in salary Philippines?

How much tax is deducted from salary Philippines?

How can I calculate my tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 8404 for eSignature?

How do I complete IRS 8404 online?

Can I create an electronic signature for the IRS 8404 in Chrome?

What is 2025 form 8404?

Who is required to file 2025 form 8404?

How to fill out 2025 form 8404?

What is the purpose of 2025 form 8404?

What information must be reported on 2025 form 8404?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.